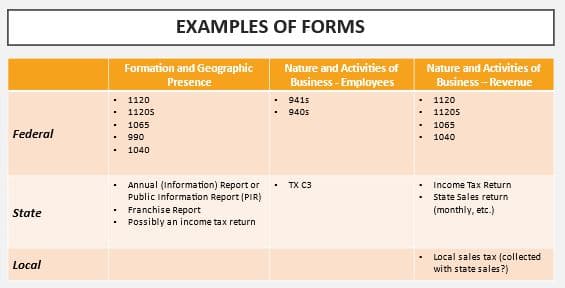

Tax Obligations are a function of the formation type of a company and the states in which the company is formed plus the states in which the company has a business presence. Tax obligations also come from the nature and activities of a business: the company’s fiscal year; whether there are employees; whether there is revenue and expenses (or a loss); and whether state sales have to be collected.

Business owners can also think about tax obligations by the different levels of government: federal, state and local.

One of the most common mistakes by startups and early state companies is not “registering” or “qualifying” in every state in which there is a business presence.

- In each state, a business will usually have a relationship with two state agencies: the secretary of state and the taxing authority for the state. In Texas, the taxing authority is the Comptroller of Public Accounts but other states call their taxing authority the Department of Revenue.

- At the state level, business owners often owe a franchise tax even if they do not owe an income tax return. A franchise tax is for the annual right to own a company in a state.

- For those businesses that are incorporated in Delaware (DE), the DE franchise tax can be calculated one of two ways. In most instances for startups and early state companies, the Assumed Par Value method should be method used.

There are myriad details to understand about a company’s tax reporting requirements and obligations. To simplify:

- Know the forms required and the due dates

- Ensure your business is register or qualified in each state you have a presence

- Manage your cash flow to pay on time.

- Set up a recurring calendar with the key dates and stay on top of it

Principal

lloftus@loftusmanagement.com

Originally presented at VelocityTX on Jan. 27, 2022.